First of all, congratulations! You finished senior high school and also you are ready to begin a brand-new phase in your life. Whether you have actually determined to attend college and also work part-time, or a job permanent for a year after high school, these economic pointers will assist you to establish on your own and also guarantee that you will accomplish your goals.

1. Establish a favorable connection with money. That might sound really unusual, yet you require to understand that money itself is simply neutral. It’s how you manage it that establishes whether money is most likely to offer you or you are most likely to serve it. The method to establish this positive connection is to make sure that you are always in control of your cash. The key to remaining in control is to never ever spend more than you gain and also to get involved in the behavior of saving wisely.

2. Assume before you invest. You are now on your own. No one is evaluating your shoulder and also asking you how you are spending your money. It depends on you to be responsible with your money and just buy the important things you really need. Certain, you can treat yourself occasionally, however, bear in mind, only invest cash you really have, as well as never acquire points on credit that you can not pay for to repay.

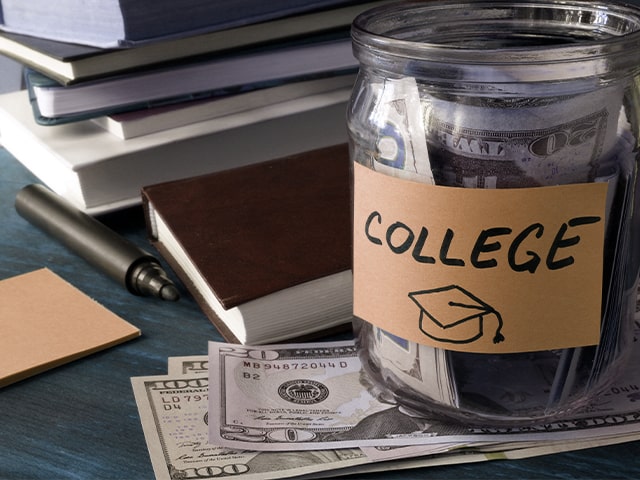

3. Beginning conserving routinely and automatically. The most effective way to save is to think of what you want to save for. You will never be inspired to conserve until you have a precise purpose for conserving. Once you have an objective in mind, the next step is to establish an interest-bearing account or a Free of tax Savings Account as well as set up pre-authorized settlements into the account. By doing this you don’t even have to consider saving, it will essentially take place immediately.

4. Get a charge card to construct your credit history. In Canada, it is extremely vital that you develop your debt. If you don’t have any type of credit report it is very difficult to be accepted for a loan or home mortgage down the road. The very best method to construct an excellent credit history is to get a bank card with a low limit. Utilize it once or twice a month for a tiny purchase, and then pay off the complete equilibrium on a monthly basis. This way it won’t cost you anything in interest but you are showing the Credit history Bureau that you can manage your credit rating sensibly. Note: Just merely obtaining a bank card and not using it will not help you build credit. Keep in mind # 2: Lugging a balance extremely close to your limits is not an excellent suggestion either.

5. Ask individuals you depend on for recommendations. Not everyone has a good monetary role model. Sometimes moms and dads can educate you on bad habits as opposed to good ones. Inquire from someone you trust who you know is economically accountable. It’s much better to pick up from other people’s mistakes instead of needing to gain from your very own, so do not hesitate to request advice.

If you can follow these suggestions, you will be well on your method to ending up being a financially accountable grownup, and also you will be even more likely to attain your goals, whatever they may be. All the best!

Come and visit their homepage to get more useful information about Young People’s Financial.